When selecting a mortgage, one of the most critical decisions is choosing the right amortization schedule. This choice significantly impacts your monthly payments and the total interest you’ll pay over the life of the loan. Here, we’ll compare three common amortization options: fixed, graduated, and interest-only.

When selecting a mortgage, one of the most critical decisions is choosing the right amortization schedule. This choice significantly impacts your monthly payments and the total interest you’ll pay over the life of the loan. Here, we’ll compare three common amortization options: fixed, graduated, and interest-only.

Fixed ...

Continue Reading →JUL

When you first opted for a reverse mortgage, it might have felt like the perfect solution to tap into your home equity and enjoy your retirement without monthly mortgage payments. As time passes, your financial situation, goals, or the market itself can change, making you wonder: ...

When you first opted for a reverse mortgage, it might have felt like the perfect solution to tap into your home equity and enjoy your retirement without monthly mortgage payments. As time passes, your financial situation, goals, or the market itself can change, making you wonder: ... The real estate market can be a bit confusing, especially when you encounter terms like “pending” and “contingent” deals. Understanding these terms is crucial whether you’re a buyer or a seller, as they can significantly impact the progression of a property transaction.

The real estate market can be a bit confusing, especially when you encounter terms like “pending” and “contingent” deals. Understanding these terms is crucial whether you’re a buyer or a seller, as they can significantly impact the progression of a property transaction. Mortgage life insurance is a type of policy designed to pay off your mortgage in the event of your death. As with any financial product, it has its pros and cons. Understanding these can help you determine whether it makes sense for your situation.

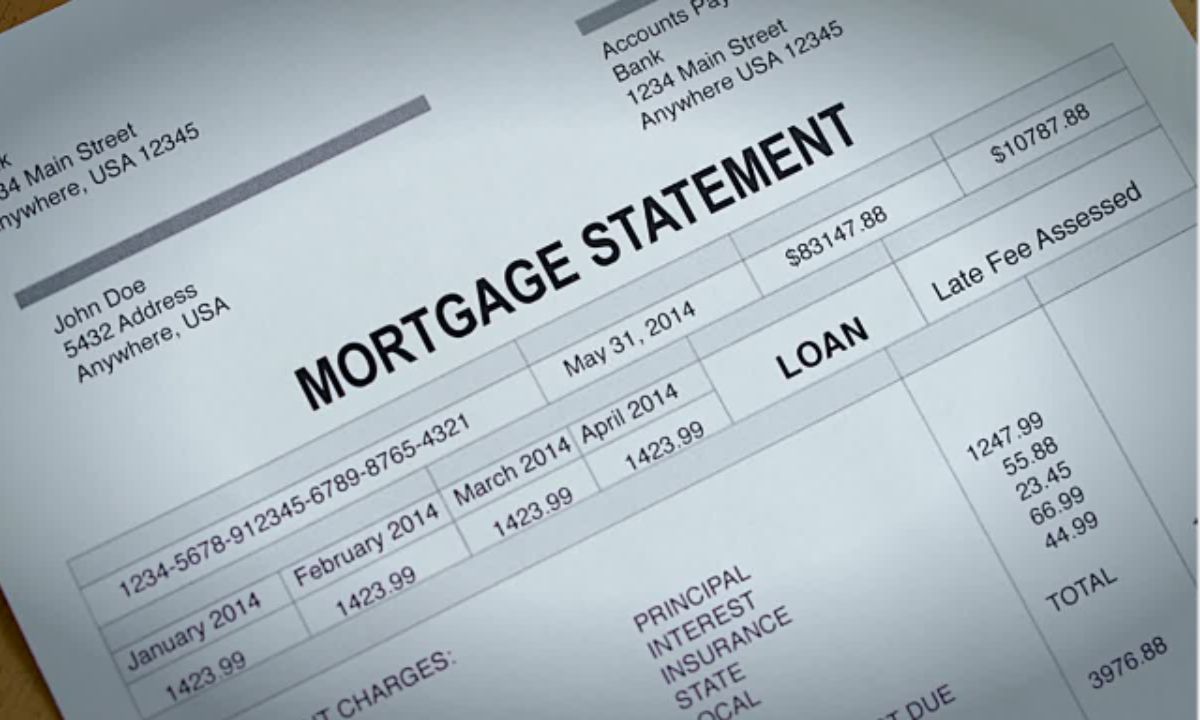

Mortgage life insurance is a type of policy designed to pay off your mortgage in the event of your death. As with any financial product, it has its pros and cons. Understanding these can help you determine whether it makes sense for your situation. Your mortgage statement is an important document that provides detailed information about your home loan. Understanding it can help you manage your mortgage more effectively, identify potential issues early, and ensure you’re on track with your payments. Here is a list to help guide you when ...

Your mortgage statement is an important document that provides detailed information about your home loan. Understanding it can help you manage your mortgage more effectively, identify potential issues early, and ensure you’re on track with your payments. Here is a list to help guide you when ... When it comes to buying a home, you will find many mortgage options available. One of the lesser-known but potentially advantageous choices is the Graduated Payment Mortgage (GPM). Let’s discuss what GPMs are, how they work, and how they differ from other mortgage options.

When it comes to buying a home, you will find many mortgage options available. One of the lesser-known but potentially advantageous choices is the Graduated Payment Mortgage (GPM). Let’s discuss what GPMs are, how they work, and how they differ from other mortgage options. Refinancing your home can be a smart financial move, offering you the chance to secure a better interest rate, reduce monthly payments, or even tap into your home’s equity. However, one of the most common questions homeowners have is: “How long does it take to refinance ...

Refinancing your home can be a smart financial move, offering you the chance to secure a better interest rate, reduce monthly payments, or even tap into your home’s equity. However, one of the most common questions homeowners have is: “How long does it take to refinance ... Buying a new home is exciting, but it comes with a fair share of paperwork, especially when applying for a mortgage. One crucial component lenders will analyze is your proof of income. Let’s take a look at what proof of income involves, document examples, and where ...

Buying a new home is exciting, but it comes with a fair share of paperwork, especially when applying for a mortgage. One crucial component lenders will analyze is your proof of income. Let’s take a look at what proof of income involves, document examples, and where ... Refinancing your mortgage can be a smart financial move, offering potential savings, access to cash, or improved loan terms. With various refinancing options available, it’s essential to understand what each type entails to make an informed decision. Let’s look into five popular types of refinance loans: ...

Refinancing your mortgage can be a smart financial move, offering potential savings, access to cash, or improved loan terms. With various refinancing options available, it’s essential to understand what each type entails to make an informed decision. Let’s look into five popular types of refinance loans: ...