As a mortgage originator, I often encounter homeowners and buyers looking for ways to finance their home improvement projects. Renovation loans offer a fantastic solution, enabling you to upgrade and personalize your home while incorporating the cost into your mortgage. We will explore the different renovation loan ...

As a mortgage originator, I often encounter homeowners and buyers looking for ways to finance their home improvement projects. Renovation loans offer a fantastic solution, enabling you to upgrade and personalize your home while incorporating the cost into your mortgage. We will explore the different renovation loan ...

JUL

When you’re applying for a mortgage, lenders scrutinize several aspects of your financial life to determine your eligibility. One crucial factor that can significantly influence the outcome is your employment history. Consistent and stable employment demonstrates to lenders that you have a reliable income stream, which ...

When you’re applying for a mortgage, lenders scrutinize several aspects of your financial life to determine your eligibility. One crucial factor that can significantly influence the outcome is your employment history. Consistent and stable employment demonstrates to lenders that you have a reliable income stream, which ... A career change is usually an exciting journey, it offers new opportunities and growth. It can also bring challenges when you have a mortgage to manage. Balancing a new job and financial commitments can be stressful, but with the right strategies, you can stay on top ...

A career change is usually an exciting journey, it offers new opportunities and growth. It can also bring challenges when you have a mortgage to manage. Balancing a new job and financial commitments can be stressful, but with the right strategies, you can stay on top ... What is a Green Mortgage?

What is a Green Mortgage? Mortgage life insurance is a type of policy designed to pay off your mortgage in the event of your death. As with any financial product, it has its pros and cons. Understanding these can help you determine whether it makes sense for your situation.

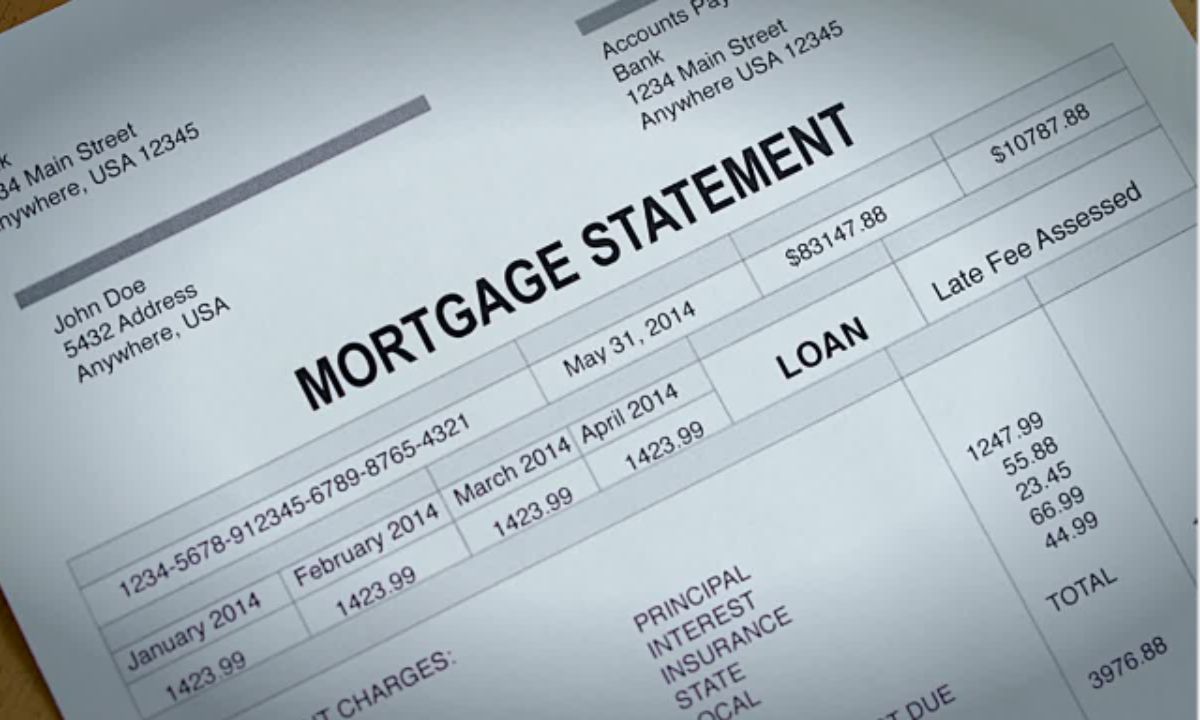

Mortgage life insurance is a type of policy designed to pay off your mortgage in the event of your death. As with any financial product, it has its pros and cons. Understanding these can help you determine whether it makes sense for your situation. Your mortgage statement is an important document that provides detailed information about your home loan. Understanding it can help you manage your mortgage more effectively, identify potential issues early, and ensure you’re on track with your payments. Here is a list to help guide you when ...

Your mortgage statement is an important document that provides detailed information about your home loan. Understanding it can help you manage your mortgage more effectively, identify potential issues early, and ensure you’re on track with your payments. Here is a list to help guide you when ... When it comes to buying a home, you will find many mortgage options available. One of the lesser-known but potentially advantageous choices is the Graduated Payment Mortgage (GPM). Let’s discuss what GPMs are, how they work, and how they differ from other mortgage options.

When it comes to buying a home, you will find many mortgage options available. One of the lesser-known but potentially advantageous choices is the Graduated Payment Mortgage (GPM). Let’s discuss what GPMs are, how they work, and how they differ from other mortgage options. Owning a home is a dream come true for many, but amidst the joy of owning a piece of property, many responsibilities can often catch homeowners off guard. While the initial purchase price and mortgage payments are the most obvious expenses, the lesser-known significant costs associated ...

Owning a home is a dream come true for many, but amidst the joy of owning a piece of property, many responsibilities can often catch homeowners off guard. While the initial purchase price and mortgage payments are the most obvious expenses, the lesser-known significant costs associated ... When it comes to building wealth and securing your financial future, a mortgage can be a powerful tool. While taking on debt might seem counterintuitive to achieving financial freedom, a mortgage, when managed wisely, can provide numerous benefits. Here’s how leveraging a mortgage can pave the ...

When it comes to building wealth and securing your financial future, a mortgage can be a powerful tool. While taking on debt might seem counterintuitive to achieving financial freedom, a mortgage, when managed wisely, can provide numerous benefits. Here’s how leveraging a mortgage can pave the ...