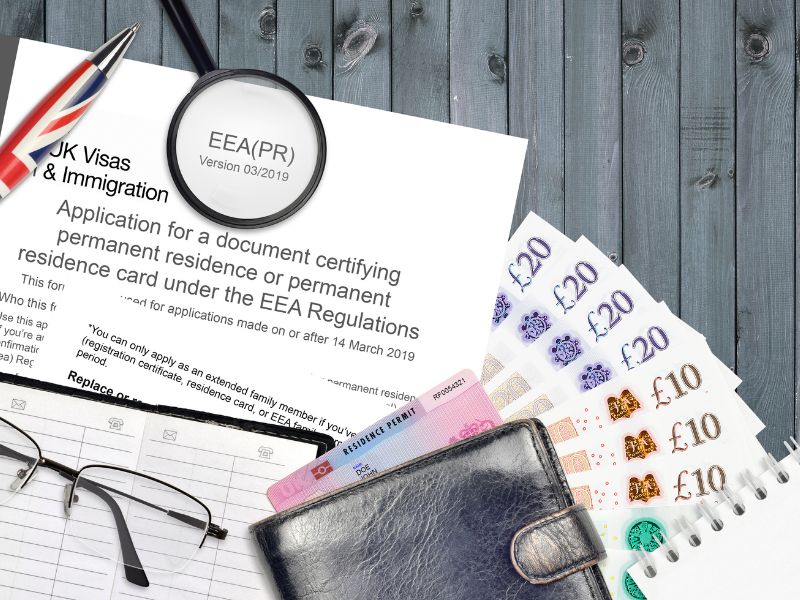

Becoming a homeowner in a foreign land is an exciting yet intricate journey. For non-U.S. citizens, securing a mortgage in the United States involves understanding and meeting specific requirements. We will explore the essential prerequisites and considerations for non-U.S. citizens aspiring to own a piece ...

Becoming a homeowner in a foreign land is an exciting yet intricate journey. For non-U.S. citizens, securing a mortgage in the United States involves understanding and meeting specific requirements. We will explore the essential prerequisites and considerations for non-U.S. citizens aspiring to own a piece ...

DEC

If you’re planning to remodel or renovate your home in the near future – whether to provide a better living environment or as part of a house flip – you’ll need to find a way to pay for your home improvements. There are several different possible sources ...

If you’re planning to remodel or renovate your home in the near future – whether to provide a better living environment or as part of a house flip – you’ll need to find a way to pay for your home improvements. There are several different possible sources ... The contemporary trend towards expansive dimensions is palpable in various aspects of modern life. Oversized soft drinks, large fast-food meals, and expansive smartphones have become ubiquitous. However, one unlikely sector experiencing a similar trend is the realm of mortgages.

The contemporary trend towards expansive dimensions is palpable in various aspects of modern life. Oversized soft drinks, large fast-food meals, and expansive smartphones have become ubiquitous. However, one unlikely sector experiencing a similar trend is the realm of mortgages. Are you in the market for a new home? If you plan on using mortgage financing to buy your next home you’ve likely heard the phrase “loan-to-value” or the acronym “LTV” before. Let’s take a quick look at the loan-to-value ratio including why it’s important, how to calculate it, and how it can affect your mortgage.

Are you in the market for a new home? If you plan on using mortgage financing to buy your next home you’ve likely heard the phrase “loan-to-value” or the acronym “LTV” before. Let’s take a quick look at the loan-to-value ratio including why it’s important, how to calculate it, and how it can affect your mortgage. Many mortgage payments are made up of four parts, called PITI. PITI is an acronym that stands for principal, interest, tax, and insurance. It’s important to understand PITI because it is the real number you need to use in order to find out how much mortgage you can afford to pay each month.

Many mortgage payments are made up of four parts, called PITI. PITI is an acronym that stands for principal, interest, tax, and insurance. It’s important to understand PITI because it is the real number you need to use in order to find out how much mortgage you can afford to pay each month. While there are differing schools of thought when it comes to whether or not a person ...

While there are differing schools of thought when it comes to whether or not a person ... Getting a mortgage is a significant financial decision, and it is crucial to ensure that you are financially prepared before applying for one. Conducting a quick financial health check before applying for a ...

Getting a mortgage is a significant financial decision, and it is crucial to ensure that you are financially prepared before applying for one. Conducting a quick financial health check before applying for a ... In the realm of real estate, market conditions can differ significantly due to a variety of factors. One such state is known as a seller’s market, which typically benefits those wanting to sell their property. Let’s dive into what makes a seller’s market advantageous for homeowners looking to offload their house and why ...

In the realm of real estate, market conditions can differ significantly due to a variety of factors. One such state is known as a seller’s market, which typically benefits those wanting to sell their property. Let’s dive into what makes a seller’s market advantageous for homeowners looking to offload their house and why ... If you dream of owning a house one day, you have probably realized that one of the biggest challenges is saving money for a down payment. You have already found your dream property, but then the lender asks you ...

If you dream of owning a house one day, you have probably realized that one of the biggest challenges is saving money for a down payment. You have already found your dream property, but then the lender asks you ... If you’re about to seek approval for a mortgage, you’ll want to ensure you have a solid credit score and clean financial ...

If you’re about to seek approval for a mortgage, you’ll want to ensure you have a solid credit score and clean financial ...