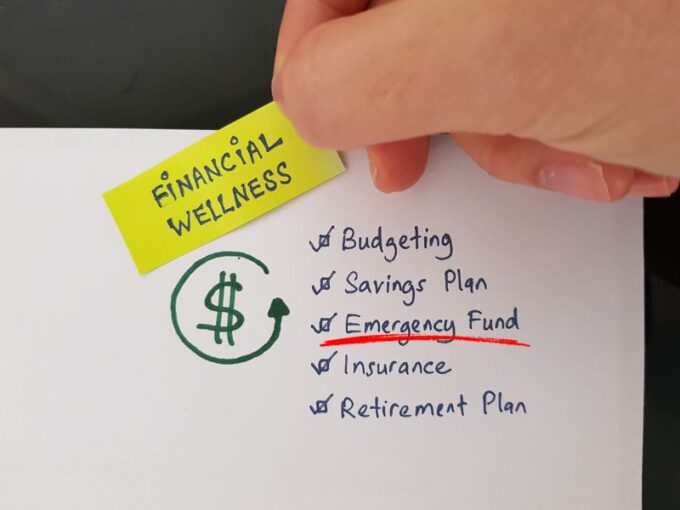

It’s important to be financially prepared for emergencies so that you can handle unexpected expenses or situations without having to worry about your financial stability. Here are some ways to financially prepare for emergencies:

It’s important to be financially prepared for emergencies so that you can handle unexpected expenses or situations without having to worry about your financial stability. Here are some ways to financially prepare for emergencies:

Build an emergency fund: Start by building an emergency fund that can cover at least 3-6 months of your living expenses. This fund should be kept in a separate savings account and should only be used for emergencies.

Create a ...

Continue Reading →NOV

The holiday season is a time of joy and celebration, but it can also be a challenging time for your finances, especially if you’re juggling the responsibilities of a mortgage. However, with some thoughtful planning and budgeting, you can ensure that you enjoy the festivities without putting your financial stability at risk. I will provide you with essential tips and strategies to help you manage your mortgage budget during the ...

The holiday season is a time of joy and celebration, but it can also be a challenging time for your finances, especially if you’re juggling the responsibilities of a mortgage. However, with some thoughtful planning and budgeting, you can ensure that you enjoy the festivities without putting your financial stability at risk. I will provide you with essential tips and strategies to help you manage your mortgage budget during the ... When someone is looking at purchasing a home, they usually focus on the purchase price of the home and the potential monthly payment. At the same time, there are other costs that need to be included as well. This includes home insurance and real estate taxes.

When someone is looking at purchasing a home, they usually focus on the purchase price of the home and the potential monthly payment. At the same time, there are other costs that need to be included as well. This includes home insurance and real estate taxes.

If you are planning on purchasing a home in the near future, you need to make sure you have enough money saved up. While there are ...

If you are planning on purchasing a home in the near future, you need to make sure you have enough money saved up. While there are ... Right now, mortgage rates have fallen to rates that haven’t been seen in years. This opens the door for many people to apply for a mortgage that they previously may not have ...

Right now, mortgage rates have fallen to rates that haven’t been seen in years. This opens the door for many people to apply for a mortgage that they previously may not have ... For those who are looking to buy a home, they know that this is one of the most exciting experiences ...

For those who are looking to buy a home, they know that this is one of the most exciting experiences ... By now, it should be apparent that this COVID-19 (Corona-virus) pandemic is going to be here for several months. It is already causing the market to plummet and is disrupting jobs all over the country. Many people who work ...

By now, it should be apparent that this COVID-19 (Corona-virus) pandemic is going to be here for several months. It is already causing the market to plummet and is disrupting jobs all over the country. Many people who work ... Those who are looking at buying a home need to think about whether or not they are truly ready for this responsibility. When someone takes out a mortgage, this is frequently the largest loan someone will ever ...

Those who are looking at buying a home need to think about whether or not they are truly ready for this responsibility. When someone takes out a mortgage, this is frequently the largest loan someone will ever ... Most people can’t pay for a home outright, so they finance it with a mortgage loan. 30-year mortgages are more conventional, but they also come with a significant interest price tag.

Most people can’t pay for a home outright, so they finance it with a mortgage loan. 30-year mortgages are more conventional, but they also come with a significant interest price tag.